Last weekend (May 2-4, 2025), I went to Omaha to hear Warren Buffett speak at the Berkshire Hathaway annual meeting. It’s an event that typically hosts 40,000 people, and grew over the years to what has been dubbed the “Woodstock for Capitalists” – with an almost concert/carnival/”groupie”-like atmosphere (but for finance and business folks). And alas, it’s probably the final one, since Buffett stunned the audience in the final minutes by announcing his retirement, at age 94.

This is a bit different from many of our “family travel”-themed posts, though I did surprisingly see many families at the event. I also originally wasn’t necessarily going to write this up, though a couple things motivated me to do so:

- “Seize the day” – I originally thought about going 10-15 years ago, after a colleague had done so. I kept putting it off, until finally this year. Since Buffett won’t be CEO next year, I was fortunate that I didn’t delay any more! But still – there is a lesson about not putting things off for too long.

- The audience was much more broad and diverse than I expected. Old folks, young folks, families with kids. Lots of folks who said they flew from Asia for the remote chance of asking him a question. Yes, the finance bros from New York and Hong Kong. But there’s a surprisingly broad appeal to a wildly successful and shrewd business person who is humble and well-grounded; someone who avoids shortcuts and who takes joy in his work; and who dispenses folksy wisdom like a midwest grandfather.

Overview and Getting There

Unlike many of the other posts, this one is probably not repeatable in future years, since Buffett was the headliner who attracted the large crowds, and he won’t be CEO next year.

That said, the annual event is held in early May in downtown Omaha, at the CHI Health convention center area.

- Friday afternoon consisted of exhibits from the subsidiary companies, with some products available for purchase. It was mobbed, with a carnival atmosphere.

- Saturday from 8am-1pm was reserved for asking Buffett questions, with a 30 minute break. This was the highlight, at the end of which he announced his retirement.

- Saturday at 2pm was technically the legally required shareholder meeting, but this was fairly pre-programmed, much less attended, and less interesting, with Buffett not present. But the subsidiary exhibits were open downstairs for the afternoon.

- Some people trek for a selfie in front of Buffett’s house that he’s owned since 1958, or to his fav restaurants (note: his palate is on the simpler side). Some subsidiaries like Nebraska Furniture Mart or Borsheim’s had special sales.

Since Omaha’s airport is somewhat busy for the event, I took the suggestion of flying to Kansas City, and driving 2.5 hours. The downtown hotels were fairly booked up and expensive, so I stayed across the river in Iowa, which was only about a 15 minute drive.

It was necessary to be a shareholder to get in, though one only needs to own 1 share (price as of May 2025 is about $500 for a “B” share). But unlike your travel expenses, this one is likely to grow in value over time. They had a mail-in form earlier in the spring to request up to 4 passes; but, I’ll note some folks were selling their extras on Ebay.

Friday Exhibits

After arriving to Kansas City airport in the mid-morning, I picked up the rental car, and did the 2.5 hours drive to Omaha. You really feel like you’re in mid-America, essentially the entire drive was surrounded by farms and grain silos, with an occasional McDonalds, which I got for lunch. I made it to the Omaha convention center area and parked.

After picking up a lanyard for the pass and going through the metal detectors, my first thought – wow, this place is mobbed!

There were booths for many of the subsidiaries owned by Berkshire Hathaway. Some of the lines felt like they matched Disneyland lines! For instance, the NetJets airplane inside tour had a very long line. But the atmosphere was actually pretty upbeat.

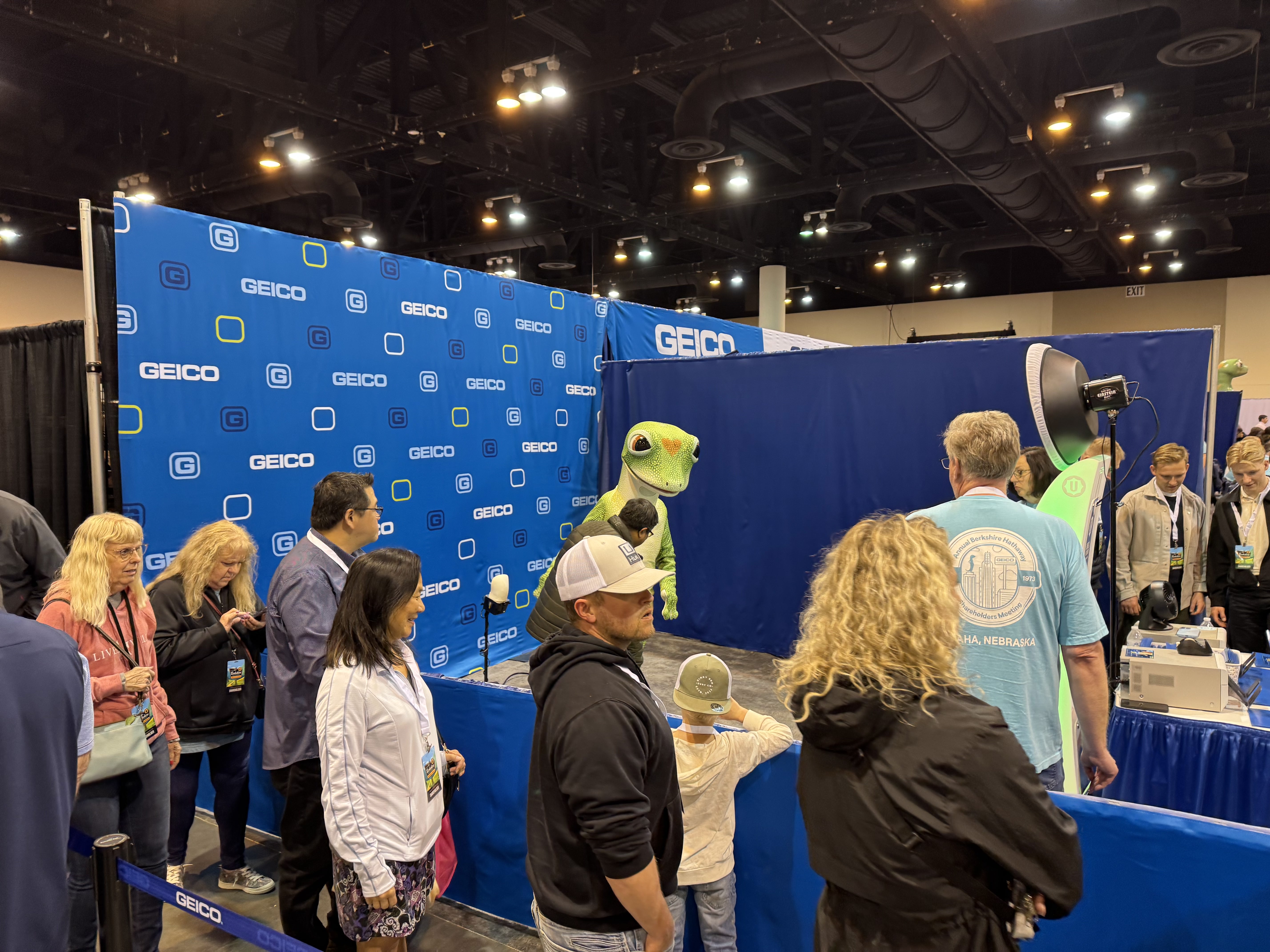

Some of the subsidiaries like Sees Candies or Dairy Queen had obvious things to sell (I confess I ate some of my commemorative Sees candy the next day after the motel breakfast proved quite subpar). Others like Clayton Homes had an interesting tour of a model home. BNSF railroads had a large model train exhibit. And Fruit of the Loom had plenty of commemorative tshirts and hoodies to buy. You could also wait in line to get a photo with the “Geico gecko”, which I did when the line got shorter.

The list of exhibits went on (Pilot truck stops, Benjamin Moore paint, Brooks shoes, Duracell Batteries, etc), kind of a monument to the company’s empire of useful services that employ roughly 400,000 people. I had never heard of some of the products like the “plushmallow” before.

After spending a while at the exhibits, I admit that I made the trek to Buffett’s house, which was a 10 minute drive west of the convention area. Note that is it a normal residential neighborhood, definitely be respectful there. I simply drove by, and snapped a photo from the car window. He’s known for having owned the same house since 1958 for which he paid $31,500. It is a nice house in a nice neighborhood there (with understandably plenty of security cameras and fencing), but not necessarily where you expect a billionaire to live. Below is a photo of folks lining to snap selfies by his gate. Additionally, in the evening I walked around downtown Omaha, which had some restaurants and actually a nice area by the river, see also below.

Saturday Annual Meeting

One thing that I underestimated was the arrival time. The meeting started at 8am, with the doors opening at 7am. Some people apparently camped out some chunk of the night. I arrived to the area just before 7am, but there was an insane mass of humanity there clamoring to get in. Felt more like a Taylor Swift concert than a stockholder’s meeting in that regard.

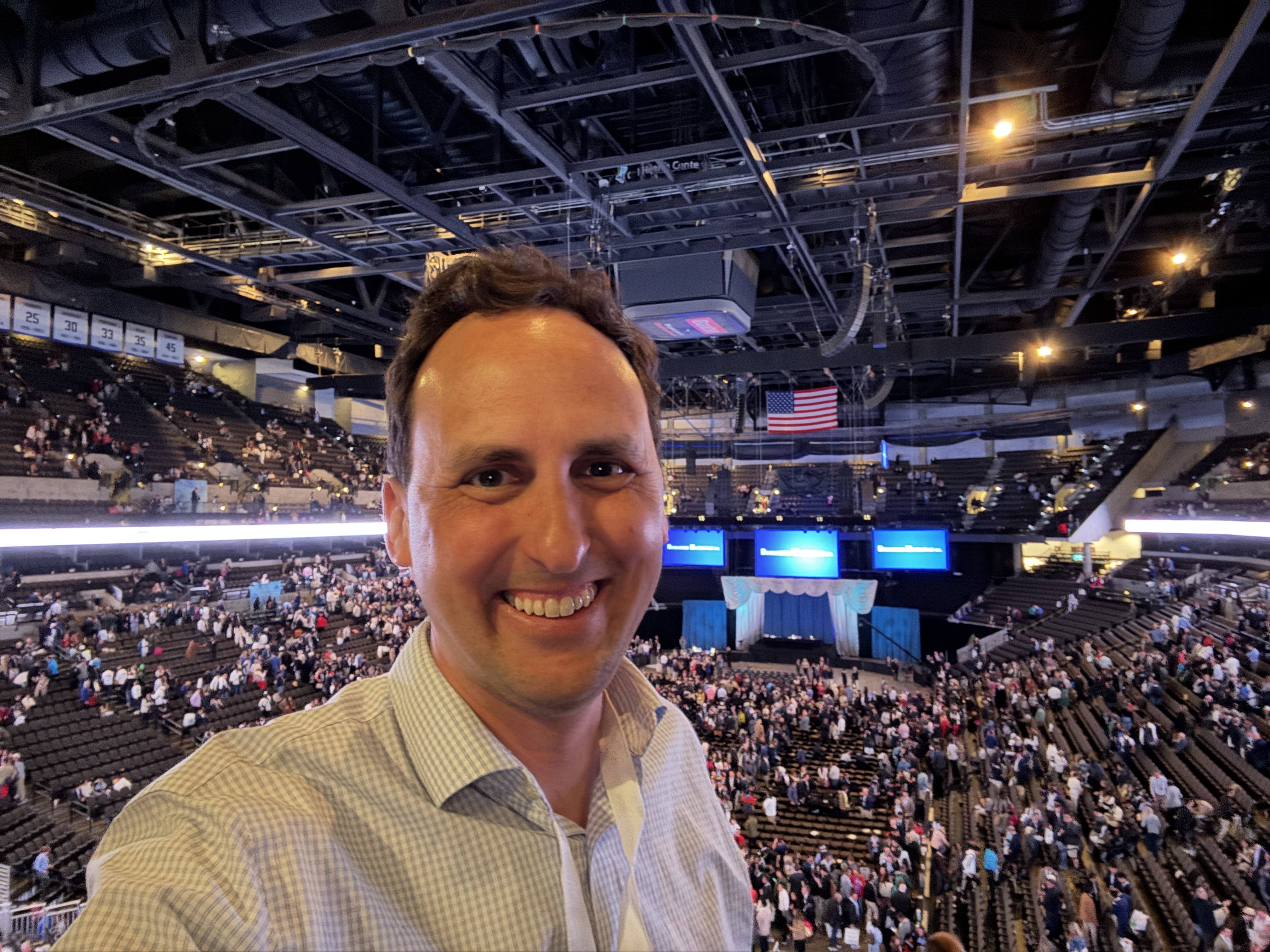

I waited in a snaking line, and took over an hour to get in. Some of the old timers in line next to me said that they’d never seen it like that before, and was unclear whether we’d get inside. I actually listened to the first few minutes of the meeting streaming on my phone, but I did eventually get in, and did find a seat at the top. Below I got a shot of myself as well during a break after people filed out.

The main highlight was the 4.5 hours that Buffett answered roughly 30 questions – they were alternating, half from a journalist who had curated questions that were sent in, and half from audience members who entered a lottery to ask a question. One of the audience members who got a chance to ask a question, stated that they had flown from China and waited in line since 2am to enter the lottery to ask a question. Another told a reporter that they got up at 4:20am, and curated every word of their question. I guess the time zone change from Asia might have helped with the early wakeup!

Buffett’s answers were generally fairly interesting, and had some folky humor to them. Some questions were fairly relevant to the company, some were just general finance or life questions. Since this isn’t a finance blog, I won’t go into detail about that – others will cover that better. One thing that I could tell from his voice is that – he’s definitely getting old. He’s 94, and his voice getting somewhat hoarse, especially towards the end. It’s still very impressive to spend 4.5 hours answering questions to an audience of tens of thousands at that age.

The Announcement

Then the surprise part was that in the final 5 minutes he told the audience that he would be stepping down as CEO at the year end, and recommending to the board that his second in charge, Greg Abel, take his place. He said that nobody in the room, besides his kids, (including the new CEO) was aware of this in advance. At that, the audience gave in a standing ovation, clapping for a long time, as a tribute to a wildly successful 7-decade career in business. Here’s a picture that I took during that ovation:

After that, folks filed out, processing the news and realizing that this was probably the end of an era, and the last such event. Folks went to the exhibits to buy more merch or to network or mill around.

Leaving and Conclusion

I did go to the technical annual meeting part an hour later since I had travelled a ways to be there. It was fairly scripted and attended by less than 10% of the regular audience. Buffett wasn’t there, and this part was quite skippable.

After that, I did look around at the exhibits for a few more minutes, and eventually started my drive back to Kansas City, where I’d fly back home from the following morning. There were some further events, but mostly secondary ones. I imagine others might have attended meetups, though my own industry is tech, not finance.

Again, one of my parting conclusions from the weekend is that if there’s something you’ve been thinking about doing for some time – do eventually make plans to do so, before it’s too late. I was fortunate to do so this time (and never in my imagination did I expect to be present for his retirement announcement!). But, sometimes with life commitments, it’s easy to delay things for too long.

More From Our Blog

Keep reading our travel blog for more adventures in the USA: